Using stop losses can help you limit your losses. Depending on how much money you have to lose, you can set a limit of one to three percent of your portfolio value. You may want to set the limit lower if you have had some losses recently. You can also choose to use a trailing stop loss.

The downside to using stop loss orders is that they lock in your losses. This means that if you sell at $97 and then a buyer comes along, your order will be cancelled. It may also cause you to take a large loss if you place it too far off the current price. When you use a stop order, make sure it’s far enough from the current price to avoid a large loss.

Stop-loss orders are often used by investors to limit their losses when they open new positions. For example, a trader might buy a hundred shares of a new tech stock at $25 a share. To avoid a large loss, he or she would set a stop-loss order at twenty percent below the purchase price. This would mean a maximum loss of $20 if the stock price reaches the stop-loss level.

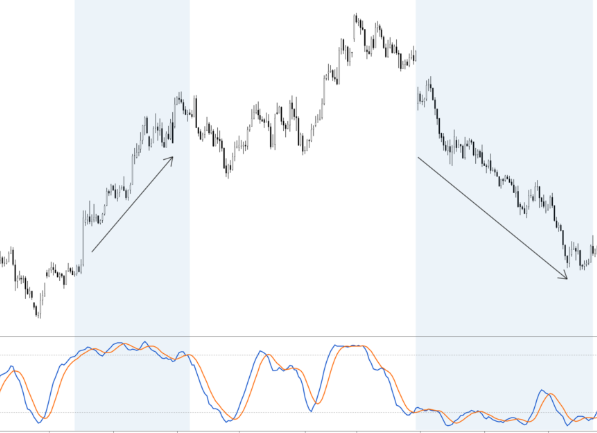

Trailing stops are another effective risk management tool. They trail your trade until the trailing stop has been reached. The trailing stop can be a percentage or a fixed number of points below the market price. If a stock price is rising, it will move back toward your trailing stop, which reduces the amount of risk to you. This way, you’ll lock in your profits and avoid losses.

Another risk is taking out known stop levels and being shaken out of a position due to a short-term price spike. This can happen if you’re not careful enough, so it’s crucial to learn how to use stop losses in trading. There are also different types of stop orders for different kinds of investments, so it’s essential to choose the right one for your trading strategy.