Choosing a moving average for swing trading can be tricky. Many swing traders prefer using a higher period setting because the higher it is, the later it will be – so the lower it is, the earlier it will be, and vice versa. You can also use a lower period setting to confirm trend changes – but remember, the higher the period, the later it will be. So, you can’t depend solely on a moving average to be successful at swing trading.

The best way to use a moving average for swing trading is to follow a trend. Traders can use this indicator to confirm their trades, as it smooths out price fluctuations and incorporates older data. However, the first and most important thing to remember is that past performance is no guarantee of future performance. A better way to determine a trend is to use the longer-term chart. However, if you’re a new trader, you can also use the short-term chart as a guide.

In swing trading, a moving average can be a powerful tool, but it must be used correctly. The most commonly used moving average is the 50-period MA. However, there are many types of moving averages, and some are better for day trading than others. One of the best moving averages for swing trading is the 21-period MA. This is because it reacts faster than the simple one. In day trading, a moving average can help you identify and ride trends.

A moving average is a good indicator for swing traders, but it can also be used to determine the trend. Some traders recommend a 20-day period for swing trading, while others suggest a 50-period MA for swing trading. This is a good balance between short and long-term. There are other ways to determine trend direction, but this indicator has a number of advantages for swing traders. You’ll be more profitable using it in swing trading if you choose the right time.

The moving average is an important tool to have in your arsenal of trading tools. Using it correctly will help you determine which market moves are most likely to go up and down. However, it’s important to remember that the longer your average period, the more it lags. So, it’s important to be careful not to use a longer period for swing trading – it’ll only make it harder to predict the market’s future direction.

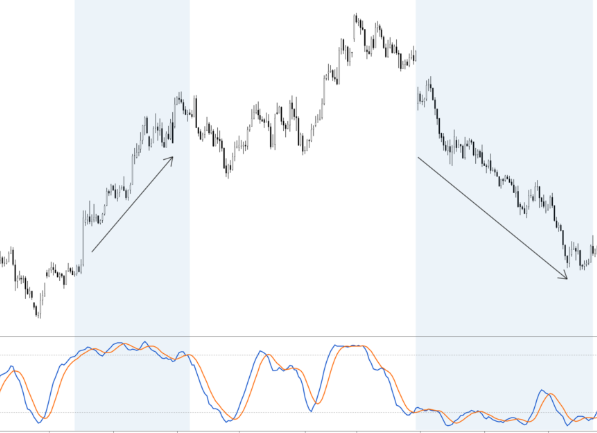

Another important factor to remember when using a moving average for swing trading is its ability to help identify trend signals. By identifying trend signals in the simplest way, you can predict a trend and exit based on your trading strategy. It is also important to remember that trends can reverse and it’s important to make sure you exit when they do – but before that happens, you can use the moving average to help minimize your losses.