Well, to answer the title of this post, it was pretty, pretty bad. The Buy/Sell Difference measured by 4% breakouts and breakdowns was -1208 today. Yesterday it was -800. The cumulative difference of the past four sessions is -2311. Looking back over my numbers since late 2007, I could find only two other instances of a day of -800 followed by a day over -1000. Those dates were September 15 and 17, 2008, and a stretch from October 2 to October 8 or so in 2008. Since then, we’ve theoretically have not seen as bad a two-day breadth move as we saw the past two sessions.

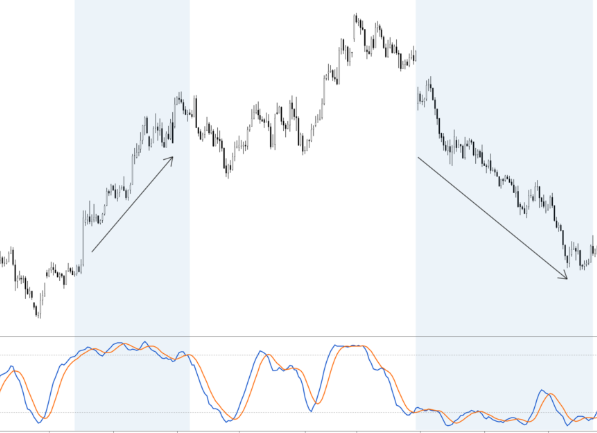

I think it is safe to assume that the bear market that started right around July 27 has now regained its strength. I’ve been saying for a while that I believed we were indeed in a bear market and that the August lows would eventually be broken, but I’m not going to lie and say I didn’t have my doubts about this idea last week as the bulls kept pushing things higher. The market went just high enough over key resistance levels (2600 on the Nasdaq as well as the 50 day moving average) and there were just enough stocks moving higher that I am pretty sure I wasn’t the only long-term bear that was questioning things just a bit. Funny how the market can do that – pull people in just enough to cut their heads off.

This isn’t to say that things will be as easy as pick a stock to short and go from there. Unfortunately, I think this market will continue to make things difficult for anyone but day traders for a while. My guess of what happens over the next few days is that we likely test the August lows either tomorrow or Monday, and will likely break through them briefly before a reflex bounce rips the face off of the bears and takes us back into the short-term moving averages. We are very, very oversold so a relief bounce (even it’s just a day or so) can happen at any time. That is strictly a guess, but in this market, what else is there to do but guess?

If you are like me and cannot day-trade, I don’t have much to tell you in terms of a game plan here other than don’t do anything. Frankly, I am becoming rather disinterested in trading right now as it is virtually impossible to do anything but day-trade and with a full-time job, that’s not possible for me. The constant gap up and gap downs make starting positions at the open impossible, and the overall volatile trendless market (if that makes sense) makes holding positions overnight with stops and such pointless. My account goes up, then gives it back, then goes up again, then gives it back. It’s gone sideways for a while now and I am actually happy I’ve started back up with my full-time job because I can’t trade as much. It’s probably a blessing.

I am in cash here and will likely be for a while, but if you’re looking for ideas, I would generally say look to short any market moves into the 9 or 20 day EMAs. We could be up 3% tomorrow or down another 4% and it would not shock me. Heck, we could be down 4% early and close up 3% and it would not shock me. It’s that type of market. As I said on Twitter earlier, “We’re back to having absolutely no long setups worth anything after today but also being way too late to do anything short. Great.” What a great market indeed (yes, that was sarcastic).