Identifying a bullish stock chart involves identifying its key characteristics. Stocks that have a rocket-like trajectory should be avoided because they rarely last longer than a couple of weeks and are inevitably followed by a sharp decline. Bullish stock charts generally show a consistent price trend from the lower left to upper right. Large advances will be peppered with consolidations that work off of extreme overbought conditions. Instead of a rocket, these charts look more like an upward mountain slope.

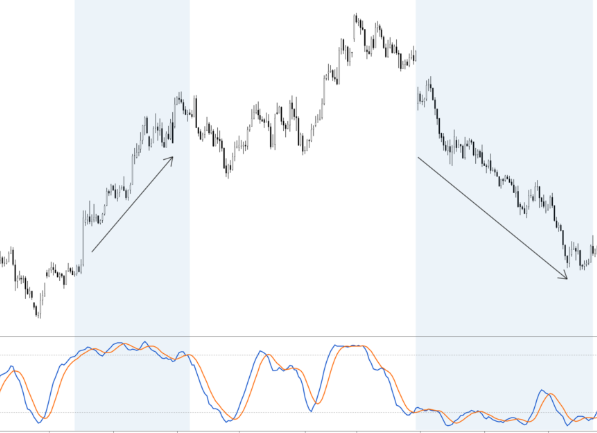

Bull flags form when a stock reaches a high point, breaks through its lower low and then rises again. A bull flag occurs when the stock exceeds the highest high point, which forces shorts to cover and buyers to get off the fence. Once a bull flag forms, the stock starts to rise and forms an uptrend. Similarly, a bear flag is an indicator that a stock is headed for a downward trend.

Candlesticks show a day’s worth of price data. Each candlestick shows an opening price, a closing price, a high and a low. The “body” of a candlestick represents the opening price, while the “tails” show the closing price. A bullish engulfing candlestick appears when the opening price of the day is lower than its previous close. If the day’s open is higher than its previous low, this indicates that buyers are pushing the price higher.

A symmetrical triangle is another reversal pattern. These charts show small swings that overlap with a large swing in the middle. The pattern is also called a double-top and a false-out. When the price reaches its low, it retests the high before falling away from the lower level. Eventually, the price will regain its original level and start an upward trend. So, before deciding on a strategy for a bullish stock chart, remember to analyze the patterns on stock charts.

Another pattern that can be used to identify a bullish trend is a bullish flag. A bullish flag pattern occurs when the price of a stock breaks above a short-term downtrend. If the flag breaks above the downtrend, traders buy. The measured-move price target is the top right corner of the flag. The bullish flag pattern generally follows an uptrend. Its price action is tight toward a point.

Similarly, a Shooting Star pattern shows that the uptrend will continue while the bears are regaining their footing. This pattern is inverse to the Hanging Man candlestick pattern, where the opening and closing prices are close to one another. If the pattern breaks lower, the market will reverse. As long as it does not break below the trend line, it will continue to climb upward. Whether the trend is bullish or bearish, there are some basic indicators to look for in the bullish stock charts.

Candlestick chart patterns are helpful in signaling buying opportunities because they indicate changes in traders’ sentiment. The breakout of a bullish candlestick pattern is accompanied by a significant upward price move. However, this pattern is not a guarantee of a trend reversal, so investors should confirm the breakout with subsequent price action. This is the key to finding bullish patterns. So, if you’re looking for a bullish stock chart, follow these tips:

Another bullish pattern is the ascending triangle. The pattern looks like a letter M and is a continuation of a previous uptrend. The first and second bottoms should be within a couple of percent of each other; the further apart they are, the more likely it is that the trend will begin an upward motion. The head and shoulders pattern also tries to determine a possible bull market reversal. The stock price creates three distinct downward movements and then breaks out from it.