Friday was a day much like other days this week, with the stock market moving higher and many individual stocks acting very well. Something happened around 1:30 however and changed things greatly – an approximate 65 point drop in the Nasdaq in about an hour followed by a thirty point rally back up in the final hour is not something you see everyday. Supposedly this drop had to do with the situation in Ukraine and actions taken by Russia. Whatever it was, a lot of individual stocks were hit (at least temporarily) and look a lot uglier than they did the night before.

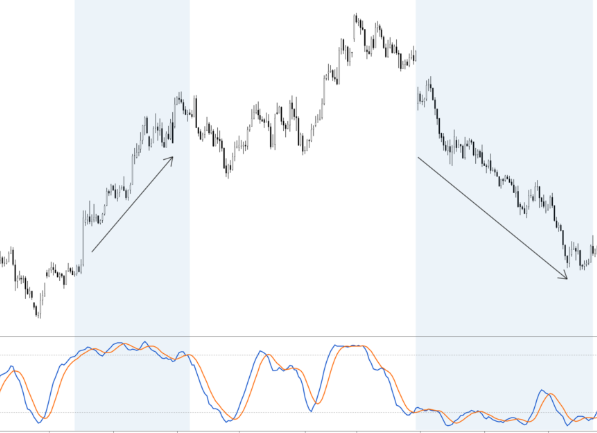

Ever since February 5, the market has been grinding along with very little rest but since it continues to hold its short-term nine day exponential moving average, it is hard to get very bearish here. Since Friday’s sell-off seemed news-driven, it is even more difficult to put a lot of importance in it. However, if Friday’s lows are broken on Monday or Tuesday, then traders should reassess their outlook and give more credence to that sell-off Friday being a warning sign rather than a shakeout.

In terms of individual stocks, there are a lot of names out there that have had great runs and are extended (TSLA, VIPS, YY, FB, FEYE, SCTY are your leaders) and therefore not very actionable right now. A week or so of rest for the overall market would not at all be a bad thing. There aren’t a ton of “easy” setups right now among high relative strength stocks.

Because of this, I went about trying to find stocks this weekend that are NOT extended. A lot of these names are low-priced stocks that have been beaten down and basing for a long time.