During the earnings season, investors and stock market traders pay attention to many different variables that affect the stock market. This includes financial data and world issues. This article will cover these factors. Economic data Several major indicators, such as unemployment, GDP and GDP growth, can affect the stock markets. Although not every piece of economic data has a direct impact on the stock market, these indicators can trigger expectations of government action. One of the biggest economic indicators is GDP, which is the dollar value of all goods and services produced in a country during a particular time period. While a good GDP figure can boost share prices, a bad one can have the opposite effect. Another indicator is the Purchasing Managers Index. This is a measure of the growth of the manufacturing sector. A positive figure suggests that businesses are performing well and that their earnings are likely to increase. The housing and construction sector is considered an important part of any economy. The number of construction projects is another indicator of a healthy economy. High construction activity […]

Using stop losses can help you limit your losses. Depending on how much money you have to lose, you can set a limit of one to three percent of your portfolio value. You may want to set the limit lower if you have had some losses recently. You can also choose to use a trailing stop loss. The downside to using stop loss orders is that they lock in your losses. This means that if you sell at $97 and then a buyer comes along, your order will be cancelled. It may also cause you to take a large loss if you place it too far off the current price. When you use a stop order, make sure it’s far enough from the current price to avoid a large loss. Stop-loss orders are often used by investors to limit their losses when they open new positions. For example, a trader might buy a hundred shares of a new tech stock at $25 a share. To avoid a large loss, he or she would set a stop-loss order at twenty percent […]

If you’ve ever wondered how to make money trading earnings on stocks, you may be wondering what factors influence their prices. Earnings are often a major factor in the price movement, but the relationship between the actual results and the resulting price move is not always straightforward. For example, while Walmart’s earnings were well above analysts’ expectations, the company’s shares were not immediately affected by its news. This is because analysts focus on the firm’s future earnings rather than its current results. However, analysts’ attention to future earnings is often more influential than the resulting price movement. Before making trades during earnings release, you should analyze a company’s reports before placing your trades. You can find out the exact time the report is released by visiting the company’s website. You can also review previous reports and get the full report when it comes out. This way, you can take advantage of the earnings release to make profits. The earnings report is just as important as any other market event. Traders should remain calm and patient during earnings reports especially trading […]

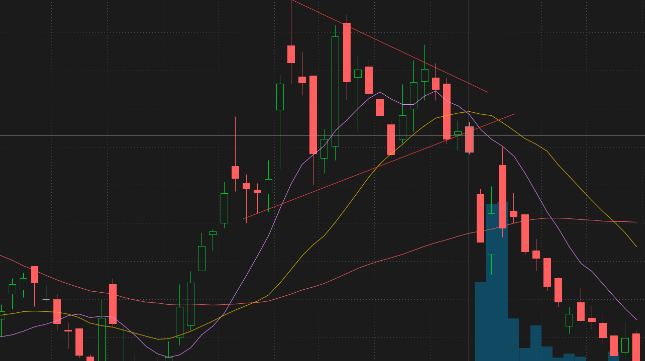

There were quite a few bullish chart setups on individual stocks. After pulling back to the 50 day moving averages, stocks bounced hard two Fridays ago and the S&P and Nasdaq looked like they were done with a slight, normal pullback. So what did we get this past week??? You guessed it. In hindsight, I should have known the ball was going to pulled out again by this market. That is what it is best at right now – tricking and confusing all traders, bulls and bears alike. It has done it so many times now that we should all be expecting it. Trading it however is a lot easier said than done because what we see with our eyes is certainly telling us one thing, whereas the market seems to just keep throwing curveballs at us that our eyes can’t judge correctly. To be perfectly honest, this market sucks but there is nothing we can do about it except accept it and try to not let it affect our returns too much in a negative way. That’s easier said […]

Identifying a bullish stock chart involves identifying its key characteristics. Stocks that have a rocket-like trajectory should be avoided because they rarely last longer than a couple of weeks and are inevitably followed by a sharp decline. Bullish stock charts generally show a consistent price trend from the lower left to upper right. Large advances will be peppered with consolidations that work off of extreme overbought conditions. Instead of a rocket, these charts look more like an upward mountain slope. Bull flags form when a stock reaches a high point, breaks through its lower low and then rises again. A bull flag occurs when the stock exceeds the highest high point, which forces shorts to cover and buyers to get off the fence. Once a bull flag forms, the stock starts to rise and forms an uptrend. Similarly, a bear flag is an indicator that a stock is headed for a downward trend. Candlesticks show a day’s worth of price data. Each candlestick shows an opening price, a closing price, a high and a low. The “body” of a candlestick […]

Well, to answer the title of this post, it was pretty, pretty bad. The Buy/Sell Difference measured by 4% breakouts and breakdowns was -1208 today. Yesterday it was -800. The cumulative difference of the past four sessions is -2311. Looking back over my numbers since late 2007, I could find only two other instances of a day of -800 followed by a day over -1000. Those dates were September 15 and 17, 2008, and a stretch from October 2 to October 8 or so in 2008. Since then, we’ve theoretically have not seen as bad a two-day breadth move as we saw the past two sessions. I think it is safe to assume that the bear market that started right around July 27 has now regained its strength. I’ve been saying for a while that I believed we were indeed in a bear market and that the August lows would eventually be broken, but I’m not going to lie and say I didn’t have my doubts about this idea last week as the bulls kept pushing things higher. The market […]