A stock index chart is an important tool in a trader’s arsenal. This visual display of historical trends of the US market indexes provides a clear picture of where prices are headed. The charts are updated each Friday evening and are available to members. PRO members have access to complete versions of these charts. Non-PRO members can view data from 1980 until today. Traders can also view historical trendlines to identify support and resistance.

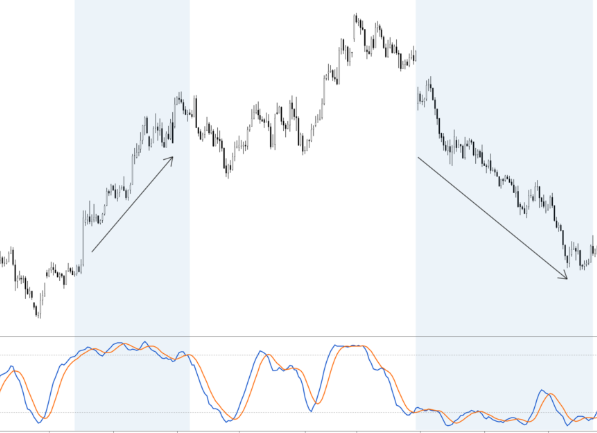

The Dow Jones Industrial Average closed below the rising 50-day EMA and has since dropped to a test of the 200-day EMA. It has not reclaimed this support, however, because bearish daily technical indicators are signaling that the support level is not going to hold. The MACD has crossed above its signal line, but remains in negative territory. The RSI has also failed to cross its 50-day EMA and is headed downward. Similarly, slow stochastic has crossed its 50% level into bullish territory, and a break of this resistance level is a good sign of further decline in the index.

The DJIA represents nearly one-fourth of the U.S. stock market value. However, because it is weighted, the percentage change in the DJIA does not necessarily reflect the market’s overall strength. It is more representative of price change, which means that a single dollar’s value will have a much larger impact on the index than a change in a $20 stock. Therefore, a daily close below 22505 would signal a near-term trend change.

The Ichimoku indicator is another indicator available in the MetaTrader 4 stock index platform. Ichimoku means “to glance at the equilibrium chart.” It attempts to predict the direction of a stock index’s price. By determining its direction, an Ichimoku indicator can help traders decide on the best entry/exit points in a stock index trade. When the Tenkan-Sen crosses the Kijun-Sen, this signals a bearish trend.

Another important stock index chart indicator is the advance/decline (A/D) index. If the A/D index is rising, then it indicates that the market is likely to see a rebound in the stock index soon. A rising A/D index will help the index’s performance, while a falling A/D index will indicate that it is losing breadth. However, it does not give buy/sell signals and is best used in conjunction with other indicators.

A stock index is a way to gauge the health of a particular market sector or country. They are based on a weighted average of a group of companies and provide investors with a broad picture. Analysts and economists use stock indexes to evaluate the viability of a market sector. By comparing the ongoing price with a previous one, the index can provide a good idea of the market’s overall health.

The S&P 500 is a stock index that originated in the nineteenth century. Henry Poor published an Investors’ Guide to Railroad History in 1860. The Standard Statistics Company (S&P) developed a stock market index and included 233 U.S. companies. Today, the S&P 500 includes 500 of the largest companies in the large-cap sector. This index is considered to be a representation of the U.S. economy.

The head and shoulders pattern appears when the market begins to fall after an advance. The head and shoulders top represents a descending pattern, while the head and shoulders bottom signals an uptrend. The head and shoulders pattern is not perfect, however. Many traders don’t base their decisions on this pattern, and instead use other indicators to determine whether or not a trade is a good one. There are a few different types of head and shoulder patterns, and they are not always indicative of a good market.

An investor can also choose to use a market capitalization weighted or price-weighted stock index chart to evaluate the performance of individual stocks. For example, the S&P 500 is a market capitalization index, which means the largest company in the index has the most influence on the overall index. Alternatively, the S&P 500 is a price-weighted index, meaning the stock price of the smaller company has a greater impact on the overall index.